Latest RBA rate hike a blow to struggling mortgage holders

The Reserve Bank of Australia has delivered another interest rate hike to struggling homeowners, with maximum borrowing capacities likely now down by around 30% since rates started rising.

At its May board meeting on Tuesday, the RBA lifted the official cash rate by 25 basis points, marking the 11th hike in its tightening cycle, bringing the cash rate to 3.85% - its highest level since April 2012.

At its meeting today, the Board decided to increase the cash rate target by 25 basis points to 3.85 per cent. It also increased the rate paid on Exchange Settlement balances by 25 basis points to 3.75 per cent. https://t.co/ZBGsPMEPNq

— Reserve Bank of Australia (@RBAInfo) May 2, 2023

PropTrack senior economist Eleanor Creagh said the RBA board’s commitment to overcoming the challenge of persistently high inflation was key to the RBA’s decision to hike rates further.

“Despite the latest monthly inflation read and the official CPI data confirming inflation peaked in December, indicating the momentum in inflation pressures is subsiding, inflation remains elevated and is well above the Reserve Bank’s 2-3% target range,” she said.

“The lift in employment seen in the most recent update on the Labour Force shows the labour market remains tight. This gave the RBA headroom to further raise the cash rate.”

Governor of the Reserve Bank of Australia Philip Low. Picture: Getty

Governor of the Reserve Bank of Australia Philip Low. Picture: Getty

Mortgage Choice chief executive officer Anthony Waldron said the decision would have been a close call for the RBA, but the latest inflation data likely forced the board’s hand.

“The RBA’s decision will likely be met with disappointment by the nation’s borrowers after the bank’s April decision to pause its recent run of cash rate hikes,” he said.

“The rising interest rate environment has cemented demand for well-priced variable rate loan products throughout 2023, with most borrowers opting for a variable rate home loan.”

Raine & Horne Property Group executive chairman Angus Raine said the hike in interest rates was like a tax and will hurt those homeowners still coming to terms with the previous 10 consecutive rate increases, in addition to higher energy and living expenses.

“That said, many consumers seem to be confident that rate increases are closer to the end than the beginning,” he said.

“CPI and inflation seem to be on the wane and I think consumers realise that we're sort of looking at the tail end of these increases and I think the RBA will probably say, ’Well, why don't we just do one more and then we'll see what the features are like when we meet next time.’”

Housing market impacts

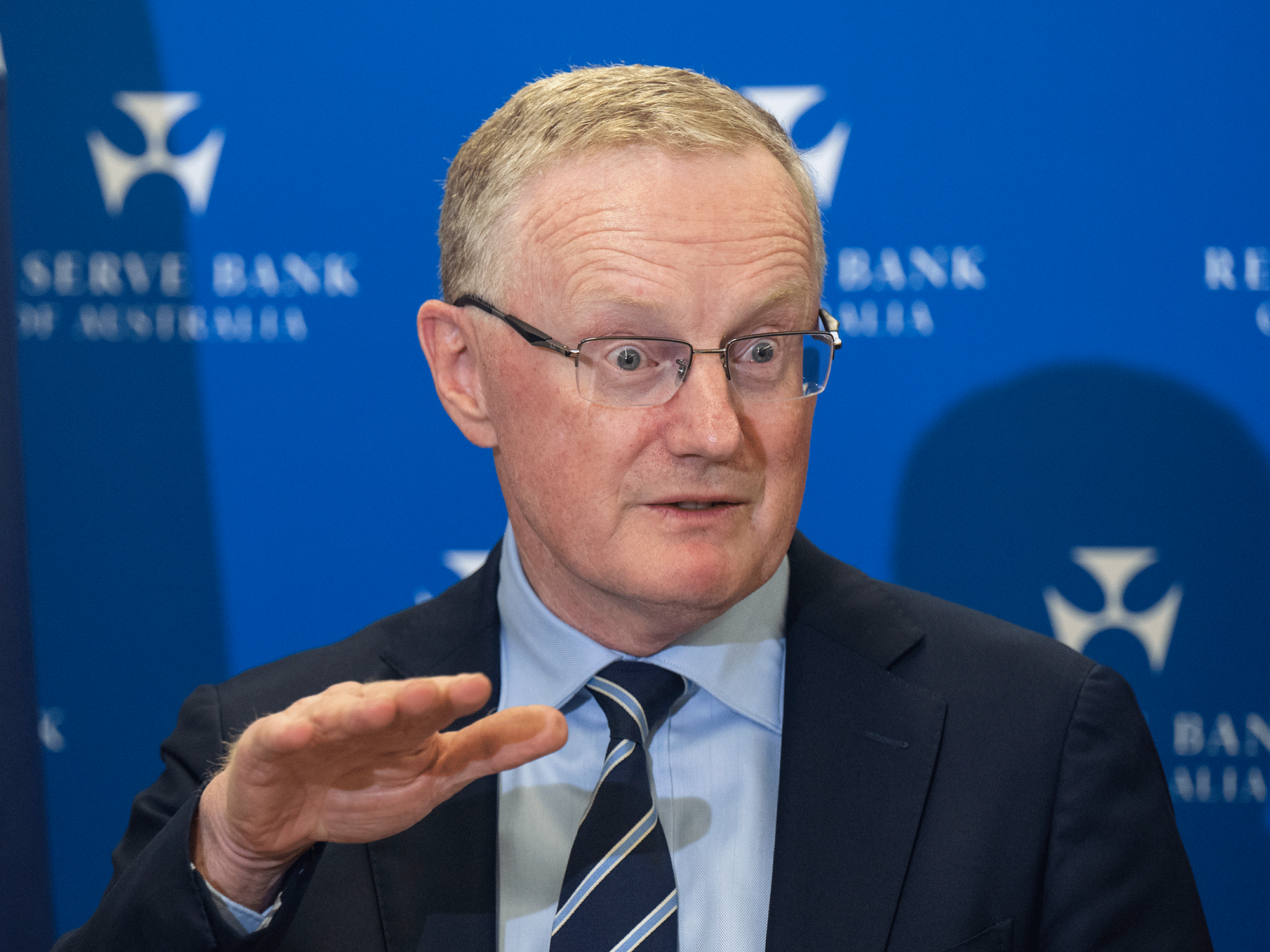

The PropTrack Home Price Index has revealed national home prices increased in April by 0.14%.

The cumulative increase in 2023 is now 0.75%, with Sydney, the market which led the downturn, now leading the recovery.

Sydney home prices have increased 1.68% year to date, and Melbourne has overtaken Sydney in terms of annual price falls.

“The housing market has started this year on a stronger footing and after nine consecutive months of price falls last year, national home prices have been rising since January,” Ms Creagh said.

“Home prices are now up 0.75% from their low recorded in December 2022.”

A further rise in interest rates comes as a blow to struggling mortgage holders. Picture: Getty

A further rise in interest rates comes as a blow to struggling mortgage holders. Picture: Getty

Supply issues offsetting worst of impacts

Strong migration, tight rental markets and limited supply have helped offset the impact of previous interest rate rises.

“Now the cash rate is sitting at 3.85% after 375 basis points of tightening to date, maximum borrowing capacities have dropped by around 30%,” she said.

“While the significant reduction in borrowing capacities and deterioration in affordability caused by interest rate rises implies larger price falls, the downward pressure is being offset.

“The impact of interest rate rises is being counterbalanced by stronger housing demand and tight supply conditions.”

The level of supply hitting the market and the trajectory of interest rates will have a strong bearing on the path for home prices in the months ahead, Ms Creagh said.

“Headwinds remain, with the full impact of rate rises already delivered yet to be felt and the possibility of further tightening still in play,” she said.

LJ Hooker head of research Mathew Tiller said market conditions have been driven by the fact new property listings were still 10% below the five-year average, underpinning competition amongst buyers.

“Another cash rate increase could encourage homeowners to sell who want to capture market momentum,” he said.

“Winter is typically a quieter time for property listings, and sellers may choose to take advantage of this to maximise their exposure in the market.”

This article was originally published as Latest RBA rate hike a blow to struggling mortgage holders.