Understanding property valuations & appraisals for refinancing

What is a mortgage valuation?

A valuation for a mortgage is a formal report, completed by an accredited valuer, to determine the market value of the security property on a home loan and ensure it is enough to cover the mortgage in the event of a forced sale.

Difference between appraisals and valuations

While valuations are formal reports carried out by a qualified valuer, appraisals differ as they are a more informal guide generally conducted by real estate professionals. As appraisals are not considered “official” valuations, they are generally a free service provided by a local real estate agent, whereas valuations will usually cost a fee as they provide a detailed analysis of the property’s value and will detail how the outcome was achieved.

A valuation will usually take into account the location of the property, as well as the property’s type, size and condition, any structural faults, any caveats or encumbrances on the property, and even local council zoning. Whereas an appraisal is likely to be determined based on a knowledge of the local area and recent history of sales prices.

A formal valuation on a property is required by lenders when determining the value of your home and is therefore needed when purchasing a property during settlement and when refinancing a home loan with another lender.

As an appraisal is treated as more of a guide to the value of your home, it is useful as a first step when looking to sell your property. An appraisal is able to provide you with an idea of your home's market value and will help your real estate agent set expectations on what your home will likely sell for.

How valuations work for refinancing

Similar to when first buying your home, if you are looking at refinancing your home loan, your lender will likely require an up to date valuation.

When refinancing your home loan, you are essentially taking out a new home loan to pay off your existing one. Whether that be with your existing or a new lender, your situation is likely to have changed and your lender will usually go through your refinance application to get up to date insights on your financial situation. The same will need to be done for your property, to ensure that if the value has increased or decreased, your loan-to-value ratio (LVR) is still at an acceptable level to refinance.

When refinancing your property, the valuation will likely be organised by your lender. However, in some instances, you are able to get an independent valuation done for your property. In order to arrange an independent valuation, you will need to source a certified practicing valuer (CPV) and check with the lender that they will be happy to accept the independent valuation over their own. It’s important to understand that in most cases the lender will organise the valuation for you at no charge, but if you choose to use an independent valuation, you will likely need to pay between $300 and $600.

Ideally, when your property needs to be valued for a refinance, you would like to see your property’s value increase and not decrease. Below we explore some of the things valuers look for to understand what’s involved in getting a full valuation of your home.

Refinancing guide

If you’re thinking about refinancing, this guide can help you learn more about the refinancing process, benefits and options available.

What valuers look for

How to prepare for an appraisal or home valuation

During a home loan or refinance application, your lender will likely order a valuation of the property. For a full valuation a valuer will need to visit the property to inspect the interior and exterior of your home and the land.

If you own the property and are getting the valuation done as part of a refinance process, you can have a more positive valuation experience by appropriately preparing for the inspection through:

- Maintaining: Cleaning and decluttering your house can go a long way in how the house is presented during the inspection. This can include some quick tidying and cleaning the inside as well as garden maintenance/landscaping outside.

- Documentation: Provide a copy of the building plans to the valuer (if available), as this can help their inspection and speed up the process. Other documentation that can be handy includes council rates notices and/or land tax valuations.

- List the property’s features: Preparing a list of your property’s features beforehand can be useful during the valuation process as it might highlight some areas of your property that could be easily missed.

These simple steps can help you prepare for your valuation and make the process smoother, whilst potentially improving your property’s overall value in the process.

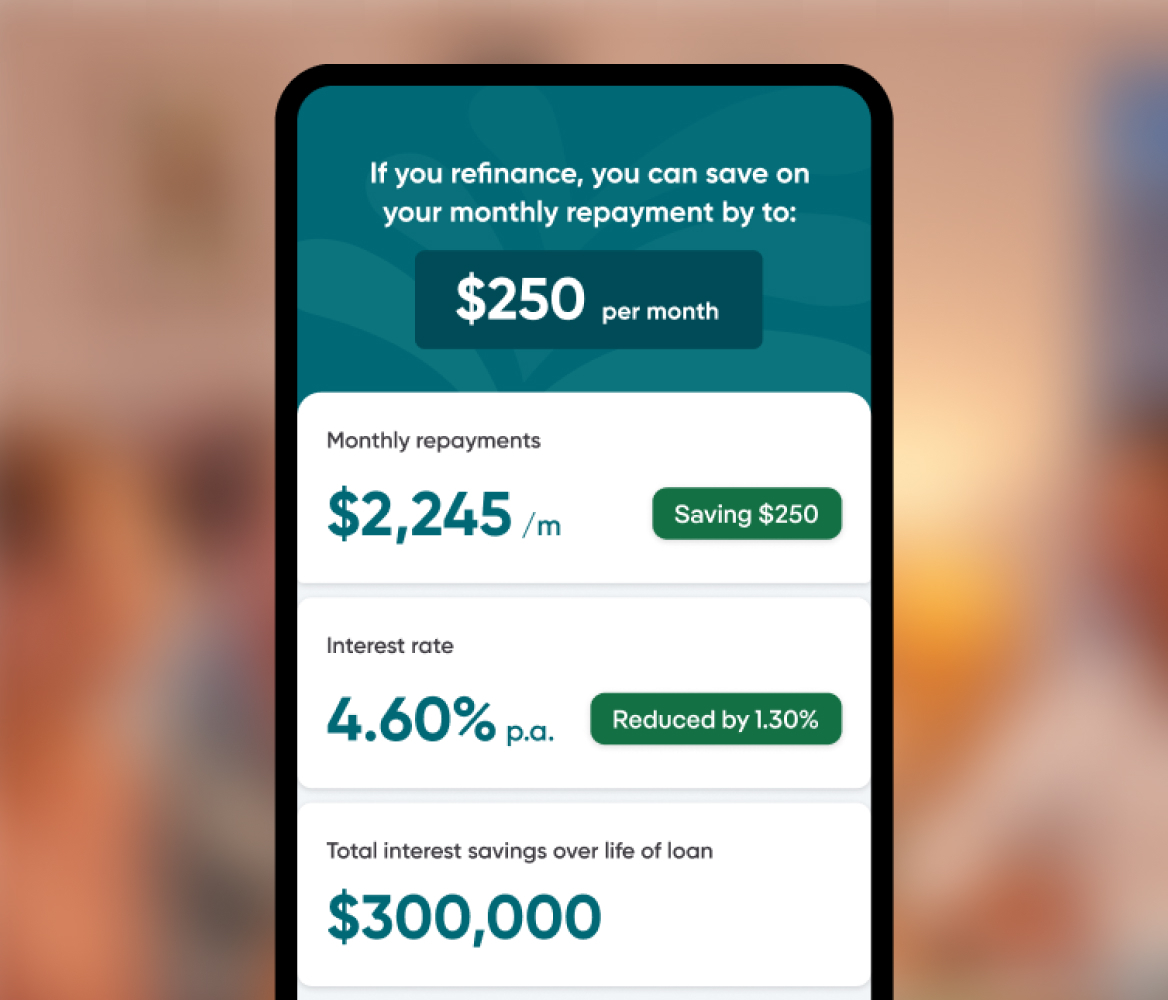

Refinancing? Find out how much you could save in 3 minutes

Compare your existing loan against thousands of home loan options and find out how much you could save on your repayments with our refinance calculator. No commitment until you are ready.

Calculate nowHow valuations work

In general valuations can work in one of two ways; an automated valuation model (AVM) or a full valuation. An AVM will likely use an internal algorithm to determine the value of the property based on property market data and the specific information relating to the features of your home. A full valuation involves a valuer attending your property to do an in house inspection. They will then combine their analysis from the inspection with comparable sales and market data when determining their decision.

Each lender will have their own valuation process, where some will perform the valuation internally and others will choose to use specific independent valuers.

Speak to your local Mortgage Choice broker to understand more about property valuations and appraisals and whether you need one for your home!