When refinancing goes wrong: Foolproof ways to make sure your money is actually working hard

When living costs are high and interest rates are dropping, more of us choose to refinance our home loans. But doing thi…

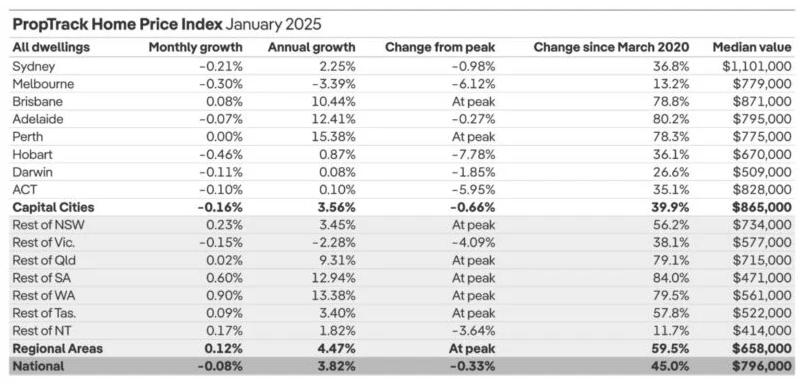

According to economic reports, by the end of the 2025 financial year, the median house price will have surpassed $1.7 million in Sydney and $800,000 in Perth. Adelaide and Brisbane will be on the cusp of cracking the $1 million median house price.

Central Coast

The proximity to Sydney and lifestyle appeal of the Central Coast, has seen more people moving which has been an increasing trend, particularly through the Covid pandemic.

The median value for property on the Central Coast is $936,048. Median rents have increased to $677 per week.

The shortage of new housing supply will continue to be the main driver of property prices in the short term.

The Central Coast has become increasingly attractive for both homebuyers and investors, offering relative affordability, strong rental returns, and lifestyle benefits within reach of Sydney.

Propertyology predicts between 3 and 6 per cent increase in property prices in 2025.

Get in touch with me on e -peter.swan@mortgagechoice.com.au or mob - 0409 965 573.

When living costs are high and interest rates are dropping, more of us choose to refinance our home loans. But doing thi…

Rentvesting has gone from being an almost-unknown term to a well-understood property strategy within the space of a few…

Housing affordability concerns have turned a corner in all but one pocket of Australia, with average loan repayments now…

Ten years ago, most people would have baulked at paying more than $1 million for a house. In fact, in 2015 just 273 of A…

Homeowners are hopeful that 2025 might bring them good fortune, as numerous forecasts suggest a series of consecutive in…

A big bank executive has revealed savvy Aussies are outsmarting sky-high property prices and the soaring cost of living,…

A regional city north of Brisbane is taking shape and is set to have new developments catering to 70,000 people. Former…

Australia’s success story with curbing inflation continues today with more positive figures published by the Austr…

With the Reserve Bank of Australia (RBA) handing down the second cash rate cut of 2025, expectations are that the market…

The Help to Buy scheme’s higher income and property price caps have been largely welcomed by property industry lea…

The Government of the Australian Capital Territory has proposed “missing middle” planning changes to boost h…

Winter might be around the corner, but the latest interest-rate cut is set to heat things up and ignite greater buyer an…

Home seekers across pockets of Sydney have been given a double dose of good fortune: their loan costs are getting cheape…

The majority of Australians making the leap onto the property ladder are managing to save the required funds without any…