Video Home Loan Meetings

A complete, remote mortgage broker service with video conference calls, remote identification verification and DocuSign paperwork.

08/05/2025

06/05/2025

Why are fixed-interest rate home loan offers currently reducing?

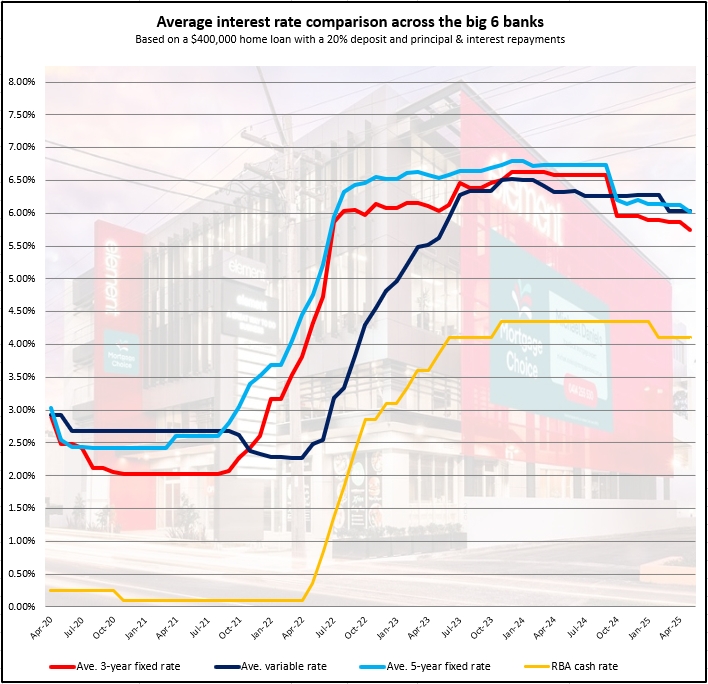

On May 5, 2025, the 3-year Australian government bond yield is about 3.451%. This number shows what people earn if they lend money to the Australian government by buying these bonds for three years. It’s like your interest in a savings account, but for bonds.

The yield on Australian government bonds influences the bank’s fixed-rate home loan in a few key ways.

1. Government bonds are considered super safe investments, so their yields set a baseline for interest rates across the economy.

2. Banks don’t just use customer deposits to fund loans; they borrow money from markets, often by issuing bonds or other debt. The rates they pay on this borrowing are influenced by competition with government bond yield offers.

3. Banks add a margin to their bond yield to cover risks (like borrowers not repaying) and make a profit. For example, if a 3-year bank bond yields 3.50%, it might charge 5.50% if it adds a 2% margin.

In short, the bond yield is like a floor for the bank’s costs and gives us a good idea of what the banks will likely offer in the form of fixed-rate home loans.

To answer our opening question, the current 3-year Australian Government Bond rate as of May 5, 2025, is set out below in a chart.

Mortgage Choice Central Coast - Erina - Michael Daniels

24/04/2025

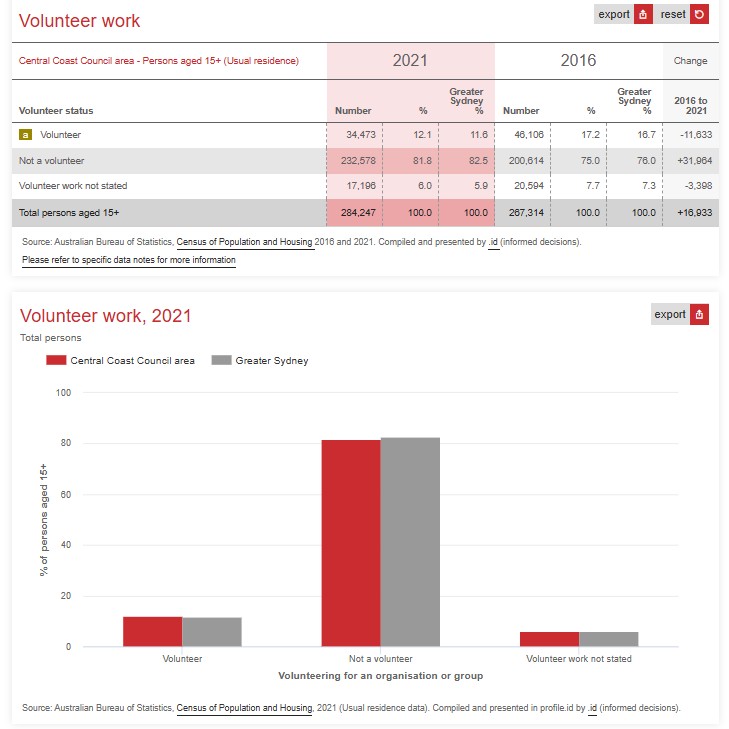

One of the most knowledgeable property analysts I have met, over my 30 years in finance, once showed me his discovery that housing markets with steady, consistent growth correlated with high levels of volunteering.

The Census measures volunteering rates. The NSW suburb with the highest rate of volunteering in 2011 was Lindfield. 27% of their adult population were volunteers. Australia was 17.8%, NSW was 16.9%, Sydney was 15.1%, and Hornsby Shire was 22.9%.

I get some of my information from a brilliant, free website that presents Census data in convenient ways. Google "id profile" if you are interested. “id profile” makes this valid point “The level of volunteering can indicate the cohesiveness of the community and how readily individuals are able to contribute to that community.”

The 2021 Census showed that Sydney's volunteer rate dropped to 11.6% from 16.7% in 2016. The 2021 Central Coast volunteering rate dropped from 17.2% in 2016 to 12.1% in 2021. I put these results down to the COVID-19 pandemic. The 2026 result will hopefully bounce back.

02/04/2025

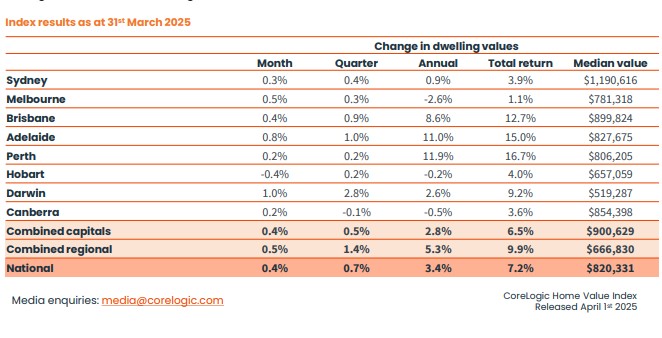

Have you seen the latest figures on median dwelling prices? Melbourne is now at $781,318, Adelaide at $827,675, and Brisbane at $899,824. It's startling, especially when you consider that Melbourne's median was $960,000 at its peak in September 2022.

Many will point to government policies, arguing that taxes and regulations have deterred investors, which is certainly a factor. However, it seems the primary driver is likely the surge in construction completions relative to other capital cities, leading to a situation where supply has outstripped demand.

21/08/2024

The right home loan for your needs

Our mission is to find the right home loan for your individual needs and to always have your best interests at heart. Plain and simple. Which is why we have such a wide range of lenders to choose from. We can search through hundreds of products to find something tailored to your situation. ~