Mortgage Choice in Hornsby

Mortgage Broker Hornsby - Michael Daniels | Mortgage Choice

Mortgage Broker Hornsby: Residential Property Market Analysis

Book an Appointment with Michael Daniels

Looking for a trusted mortgage broker in Hornsby? Michael Daniels and Mortgage Broker Hornsby - Philip Cooper, formerly the ANZ Bank Mortgage Manager at the Hornsby branch, provide expert home loan and investment property solutions across Hornsby and the Central Coast. Contact Michael at 0414 255 530 or Phil at 0459 407 310.

Hornsby Real Estate Agents - 13/05/2025

| Agent Name | Phone Number | Website |

|---|---|---|

| Chris Hopkins | +61 2 9477 3500 | Raine & Horne Hornsby |

| Daniel Dennis | +61 2 9440 9000 | Belle Property Hornsby |

| Hazel McNamara | +61 2 9485 7888 | Stone Real Estate |

| Shagufta Patel | +61 2 9876 3355 | Ray White Hornsby |

| Tarik Goktas | +61 2 8039 2000 | Saliba Estate Agents |

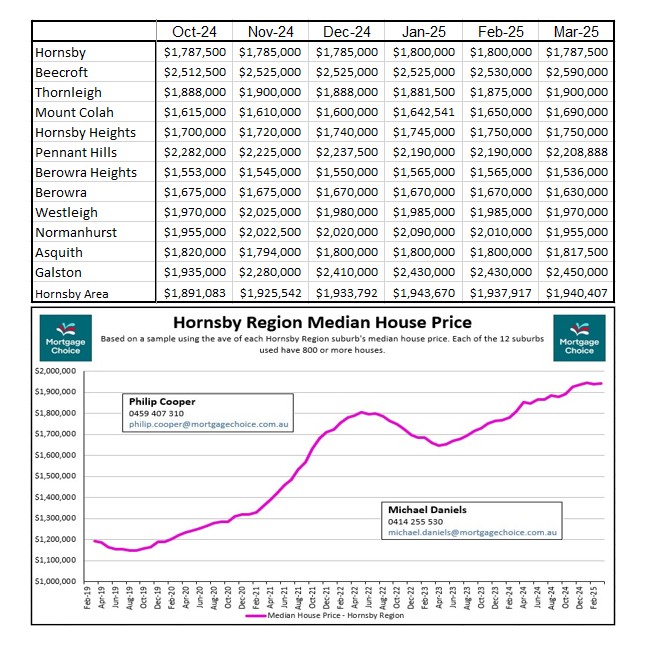

UPDATE - Hornsby Median House Price Trends - 20/04/2025

The Hornsby median house price is currently $1.940M, significantly higher than the Central Coast’s $1.029M. Since March 2023, Hornsby’s median house price has risen by approximately $300,000, surpassing its COVID-19 peak despite a 4% interest rate increase from pandemic lows.

This rapid growth highlights Hornsby’s strong property market. As your Hornsby mortgage broker, Michael Daniels can help you navigate this market to secure the best home loan or investment financing. Call 0414 255 530 for tailored advice.

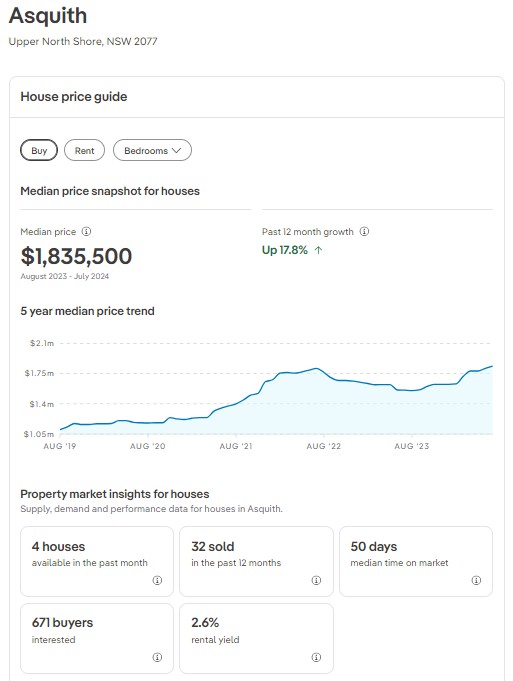

UPDATE - Asquith Median House Prices - 26/08/2024

Nearby Asquith, part of the Hornsby region, also shows strong market activity. Check the latest median house prices at realestate.com.au.

Market Overview

Hornsby’s property market is characterized by its diversity, offering everything from spacious family homes to modern apartments and townhouses. The suburb’s appeal lies in its lush parks, proximity to Ku-ring-gai Chase National Park, excellent schools, and a bustling town centre with shops, cafes, and restaurants. Its connectivity, with direct train lines to Sydney’s CBD and major roads, makes it ideal for both professionals and families. According to recent data, Hornsby listed 161 properties for lease and 117 for sale in the past month, reflecting a dynamic market with steady activity.

The median house price in Hornsby as of April 2025 stands at $1.940 million, a significant increase from $1.620 million a year prior, marking a rise of approximately $300,000 since March 2023. This growth, despite a 4% interest rate hike from pandemic lows, underscores the market’s resilience. Units, on the other hand, have a median price of around $681,000, offering a more affordable entry point for first-time buyers. Over the past five years, house prices have experienced a compound growth rate decline of 5.3%, while units have remained relatively stable, with a slight 0.1% increase. For buyers, this suggests houses are rebounding strongly, while units may offer value for those seeking affordability.

Price Trends and Investment Potential

Hornsby’s median house price of $1.940 million positions it as a premium suburb compared to the Central Coast’s median of $1.029 million. This price differential highlights Hornsby’s desirability, driven by its proximity to Sydney and robust infrastructure. For investors, the rental market is particularly attractive. Houses in Hornsby yield an average weekly rent of $750, translating to a 2.4% annual rental yield, while units command $540 per week, offering a stronger 4.3% yield. The Central Coast, including areas near Hornsby, has seen rental prices double from 2010 to 2024, with median weekly rents rising from $300 to $400 to $600 to $800. This surge is fueled by population growth, limited housing supply, Sydney’s rental spillover, and the rise of short-term rentals like Airbnb.

The rental vacancy rate across the Central Coast, relevant for Hornsby investors, is at a historic low of 1% across 37,500 rental properties as of August 2024. This tight market signals continued upward pressure on rents, making Hornsby a hotspot for investors seeking cash-flow-positive properties. A mortgage broker in Hornsby, such as Philip Cooper, formerly the ANZ Bank Mortgage Manager at the Hornsby branch, can help investors assess borrowing capacity and explore options like Self-Managed Super Fund (SMSF) loans to capitalize on these trends. With 35 years of banking experience, Philip Cooper offers personalized guidance for investment loans, refinancing, and home loans, ensuring clients secure competitive rates from a wide lender network.

Factors Driving Demand

Several factors contribute to Hornsby’s strong property market:

- Population Growth: Migration from Sydney, driven by remote work trends, has increased demand for Hornsby’s spacious homes and lifestyle offerings.

- Limited Supply: Housing development has not kept pace with demand, resulting in higher prices and rents.

- Sydney Spillover: High rents in Sydney’s inner suburbs are driving renters and buyers to Hornsby, boosting demand.

- Lifestyle Appeal: Hornsby’s green spaces, proximity to national parks, and vibrant community make it a desirable place to live.

- Infrastructure: Excellent transport links and amenities, including Westfield Hornsby and top schools, enhance its appeal.

These factors create a competitive market where buyers need expert guidance to navigate loan options and secure favorable terms. A Hornsby mortgage broker, like Philip Cooper, formerly the ANZ Bank Mortgage Manager at the Hornsby branch, can streamline the process, offering access to over 40 lenders and simplifying paperwork.

Opportunities for First-Time Buyers

First-time buyers in Hornsby face challenges due to high median prices, but opportunities exist, particularly in the unit market. Units priced around $681,000 are more accessible, and low-deposit home loans can help buyers with limited savings. Additionally, first-home buyer grants and lower Lenders Mortgage Insurance (LMI) options may be available, which a mortgage broker in Hornsby can help identify. Philip Cooper, formerly the ANZ Bank Mortgage Manager at the Hornsby branch, specializes in assisting first-time buyers with pre-approvals and tailored loan solutions, ensuring they can compete in Hornsby’s fast-paced market.

Buyers should also consider nearby Asquith, part of the Hornsby region, which shows similar market strength. Checking platforms like realestate.com.au for Asquith’s median prices can reveal more affordable options while staying close to Hornsby’s amenities. Learn more about our first home buyer services in Hornsby.

Challenges and Considerations

Despite its strengths, Hornsby’s market presents challenges. High house prices and rising interest rates (up 4% since pandemic lows) increase borrowing costs, making affordability a concern for some buyers. The low rental vacancy rate, while beneficial for investors, means renters face stiff competition, which may prompt more to consider purchasing. Additionally, the growth in short-term rentals reduces long-term rental stock, further tightening the market.

Buyers must also navigate the Loan-to-Value Ratio (LVR) and borrowing capacity, which impact loan amounts and repayment terms. A mortgage broker in Hornsby, like Philip Cooper, formerly the ANZ Bank Mortgage Manager at the Hornsby branch, can analyze these factors, offering insights into fixed versus variable rate loans, offset accounts, and redraw facilities to suit individual needs.

Why Choose a Mortgage Broker in Hornsby?

Engaging a mortgage broker in Hornsby is crucial for both first-time buyers and investors. Brokers like Philip Cooper, with his extensive experience as the former ANZ Bank Mortgage Manager at the Hornsby branch, provide access to a wide range of lenders, including major banks and non-bank lenders, ensuring competitive rates and terms. They simplify the application process, handle paperwork, and offer insights into Hornsby’s unique market dynamics. For example, Philip Cooper’s 35 years of mortgage lending expertise allows him to tailor solutions for complex scenarios, such as SMSF loans or refinancing for debt consolidation. Learn more about Philip Cooper’s expertise.

Michael Daniels, a leading Hornsby mortgage broker, offers personalized expertise, helping first-time buyers, investors, and those seeking to refinance. With deep knowledge of the Hornsby and Central Coast markets, Michael ensures you get the best home loan or investment property financing.

Testimonial: “Michael and Phil were fantastic! As a first-time buyer, their expertise as mortgage brokers in Hornsby helped me secure a great loan with ease.” – Sarah, Hornsby

Information source for Investment loans.

Information source for Refinance Advice.

Information source for First Home Buyer Advice.

Contact Michael at 0414 255 530 for expert mortgage solutions in Hornsby and beyond.

Why Work with Our Hornsby Mortgage Brokers?

Choosing a local mortgage broker in Hornsby like Michael Daniels or Philip Cooper ensures you benefit from their deep understanding of the Hornsby property market. With Philip’s 35 years of experience, including his role as the former ANZ Bank Mortgage Manager in Hornsby, and Michael’s personalized approach, our team offers:

- Access to over 40 lenders for competitive rates.

- Tailored advice for first-time buyers, investors, and refinancers.

- Expert guidance on Hornsby’s unique market trends.

- Streamlined application processes to save you time.

Read our blog on why a Hornsby mortgage broker is your best choice for more insights.

The right home loan for your needs

Our mission is to find the right home loan for your individual needs and to always have your best interests at heart. Plain and simple. Which is why we have such a wide range of lenders to choose from. We can search through hundreds of products to find something tailored to your situation. ~