Mortgage Broker in Gosford , Wyoming & Narara

MARKET UPDATE - Gosford , Wyoming & Narara

01/04/2025

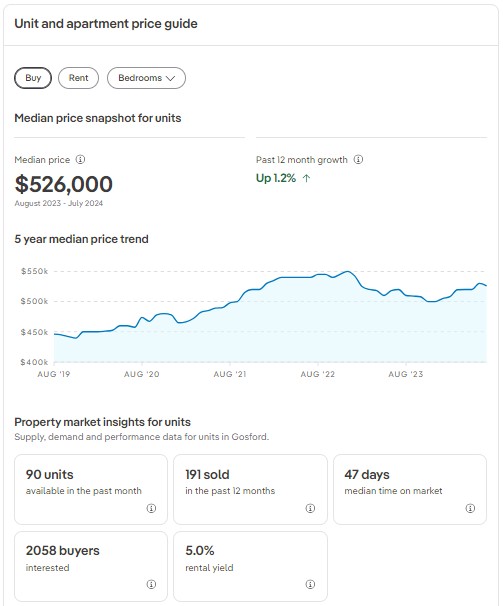

The median price for a 2-bedroom unit in #Gosford has reached $540,000, a figure that caught me by surprise. When I last checked in November 2024, the median was $530,000—identical to the value recorded in March 2022. However, a closer look at the data reveals a significant upward trend. In December 2023, the median price stood at $490,000. This indicates a growth rate of just over 10% in the seventeen months from December 2023 to July 2024 (assuming the $540,000 figure reflects recent data), highlighting a notable acceleration in property values.

Another compelling detail is the median rental yield, currently at 5.10%. For a $540,000 unit, this translates to an approximate weekly rent of $529, making it an interesting option for investors.

For first-home buyers, purchasing a $540,000 unit could come with significant financial incentives. If eligible, they might benefit from a stamp duty waiver, saving $18,829, and might also avoid lender's mortgage insurance, reducing costs by approximately $14,200. To secure such a property, a 5% deposit of $27,000 would be required, along with additional funds—around $3,000—to cover state government fees, inspection costs, and legal expenses. This brings the total upfront savings needed to roughly $30,000. With a 95% loan-to-value ratio, the mortgage would amount to approximately $513,000 (subject to credit criteria). These factors combined make a strong case for first-home buyers to consider entering the Gosford market.

27/08/2024

Median UNIT Price in Gosford www.realestate.com.au Gosford

27/08/2024

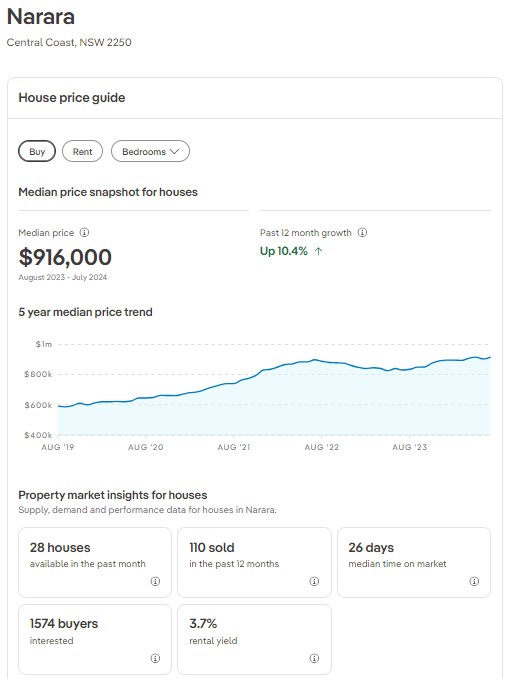

239 Properties for sale in Narara www.property.com.au Narara

27/08/2024

Median House Price for Narara www.realestate.com.au Narara

26/08/2024

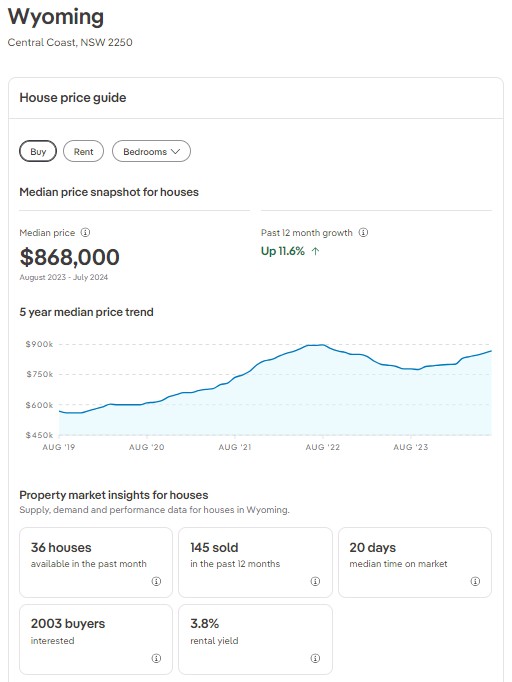

Median House Price for Wyoming www.realestate.com.au - Wyoming

21/08/2024