February 07, 2024 by Derek McLeod

Many Brisbane homeowners have witnessed a growth in their property’s value over the last few years, and this is predicted to continue into 2024. So, how could you use this to your advantage? One of the most effective methods of borrowing for investment purposes is to tap into the equity you have in your owner-occupied property. Equity can be as good as cash, and accessing this equity for investment purposes makes it possible to borrow more than 100% of the value of an investment. Here we discuss the ins and outs of the process.

Property investment is a very popular approach for Australians to growth their wealth for the future. For those who decide to invest in property, most have the following goals for their investment:

- Take advantage of the tax concessions offered by establishing and maintaining an investment in the short term, and

- In the long term, benefit from the growth in the value of their investment property.

No matter what your goal may be, the equity in your own home or other property can be a very good source of funds to help finance your investment.

It’s important first to understand the tax implications.

While you can easily use your equity for investment purposes, it’s also entirely possible to tap into equity for personal purposes.

However, the eligibility of claiming any tax deduction and receiving a tax benefit comes down to the purpose of the borrowing. This means that when assessing your annual returns, the Tax Office will ask whether the sole purpose of the expenditure was to buy and/or maintain an investment.

In general (apart from Stamp Duties), most of the cost of acquiring an investment and establishing investment finance are tax deductible, as well as the cost of maintaining an investment (e.g. interest on borrowings, bank fees, Utilities and Council charges, property maintenance, etc.) are deemed to be tax deductible.

On the other hand, if any part of the investment borrowings is used for personal purposes (such as to upgrade a private car, to renovate your owner-occupied home, or to maintain your own home), then the individual item of expenditure, or the interest on that component of the loan is not tax deductible.

Loan structure – investment vs. personal borrowings.

Another important consideration to make is that investment borrowings should be separate from your personal or owner-occupied borrowings. This makes it easy for both your accountant and the tax assessor at tax time.

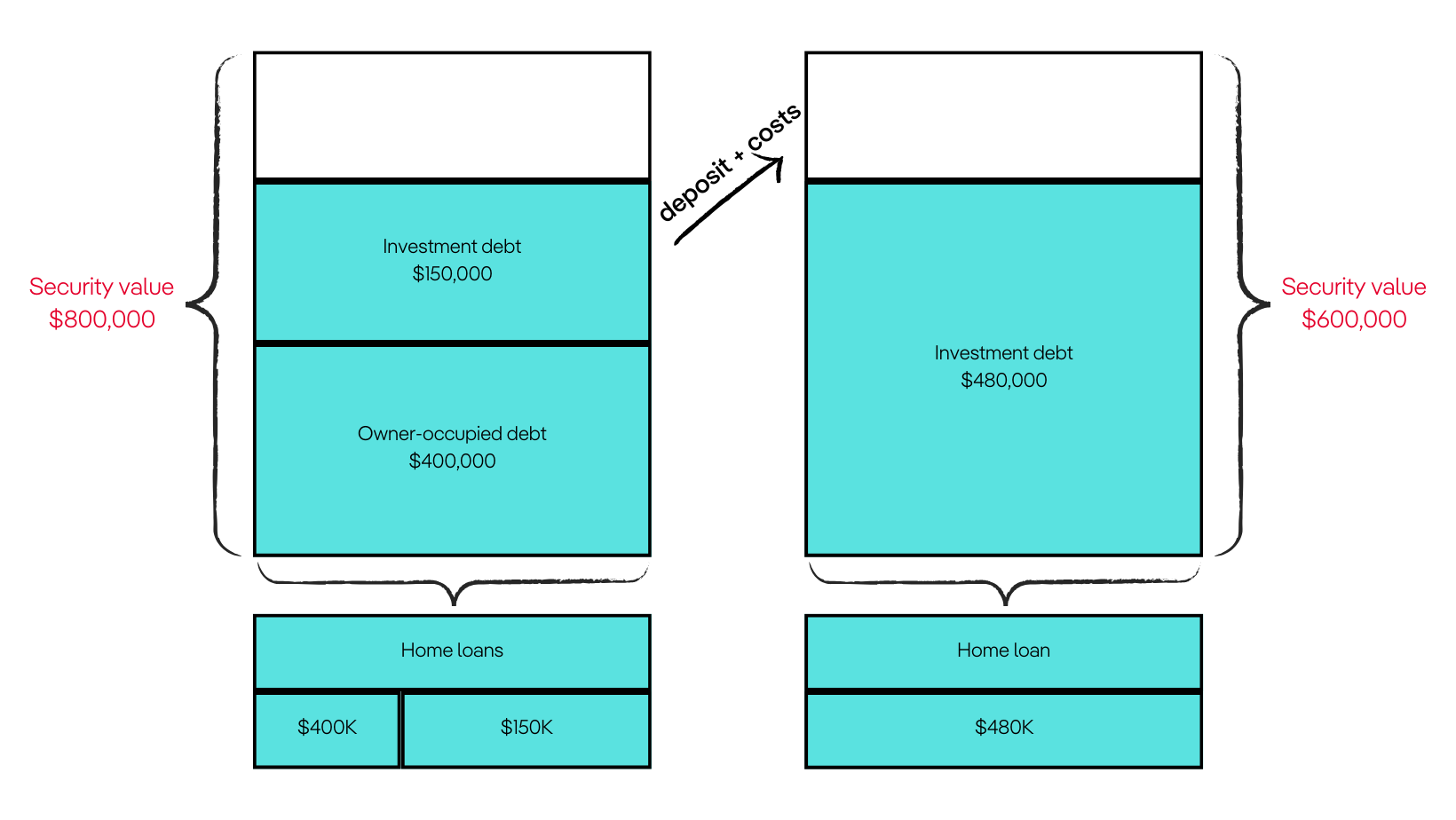

Most banks will provide finance to a maximum of 80% of the value of a property being offered as security. So, it’s a straightforward equation to determine the maximum total borrowings possible against a property. Once you have deducted the total of any personal borrowings, you are left with a figure which is the maximum amount available for investment purposes.

This available equity can then be used to establish a loan facility which becomes in effect a ‘deposit pool’ and a property management working account. When you find a suitable investment property, you can draw funds from this account for all costs associated with the purchase, such as Stamp Duties, pest and building inspections, legal fees, etc., but you can also provide a deposit to the value of 20% of the purchase price of the new property.

The balance of the funds necessary for the purchase come from a separate mortgage to the value of 80% of the purchase price, thereby avoiding lenders mortgage insurance (LMI).

This therefore allows more than 100% of the purchase price of a property to be borrowed without significant up-front costs apart from normal statutory fees and charges.

This leads to a situation where the two properties have separate mortgages but part of your total investment debt is secured by the owner-occupied property.

How does it work?

Your owner-occupied home is offered as security against a new loan which sits behind the existing owner-occupied debt - the new loan which will become investment debt. Separating the loans to isolate investment debt from personal debt will keep both the Australian Taxation Office and your accountant happy.

Here’s an example with some hypothetical values:

A loan structure such as this will provide sufficient funds for a $120,000 deposit to be put towards the purchase price of the new property, plus it would provide the funds necessary to cover the Stamp Duties and other costs associated with acquiring an investment property.

Pros & Cons of using equity to invest.

The pros of this arrangement include:

- Each property has its own separate home loans - if and when you want to sell, refinance, or fix the rate, it is not a difficult process, and each property does not have to be revalued.

- You are not compelled to go to your own bank for the purchase finance, so you are able to take advantage of better deals than may be available with your current lender.

- Depending on the equity available, and your borrowing capacity, a higher loan limit than is necessary can be accessed - this will allow for subsequent investment purchases, rather than doing it further down the track and incurring an associated ‘top-up’ cost.

- The separate loan for the purchase can be a ‘no frills’ loan, or a fixed rate can be taken advantage of.

- An investment loan against your home with a linked offset account facility allows payment of all present and future property and loan management costs from the one account.

- It is straightforward to administer for tax accounting purposes.

While the cons include:

- You will have two investment loans rather than one, and

- investment facilities do require a bit of discipline to manage.

This arrangement is by far the most efficient (and common) method for managing investment purchases, however when considering any investment, it is critical that you consult with a taxation expert to ensure that you are fully conversant with any of the tax implications.

Make your property’s equity work harder for you.

Let me help you find out if tapping into your property’s equity to invest would be a smart strategy for you now, as well as into the future for building wealth.

Contact me today for a no-obligation appointment or just to have some of your questions answered. Call me on 07 3398 8044 or simply Book an appointment online to organise a convenient time to chat or meet.